Tax Season Should Be Fun This Year

January 15th, 2015 Brian Herzog By now, hopefully you've heard what the IRS will be providing to libraries this year in the way of tax products. If not, here's the email TFOP libraries received last week:

By now, hopefully you've heard what the IRS will be providing to libraries this year in the way of tax products. If not, here's the email TFOP libraries received last week:

TFOP Filing Season Update

While we had committed to waiting until next year to making changes to the Tax Forms Outlet Program, the situation has changed. As you may be aware, IRS appropriations were significantly cut in the 2015 Omnibus Appropriations bill recently passed by Congress. Unfortunately this puts us in a position where we have very few options. We want to honor our commitment to you by providing some key products, but we cannot deliver nearly what we have in the past.

For this filing season, we will offer the following products:

- Forms 1040, 1040A and 1040EZ

- Publication 17, one reference copy for each participant (Taxpayers will be able to access Publication 17 in English and Spanish online from irs.gov/Pub17 and, new this year, it will also be available as a free e-Pub for downloading from IRS.gov and viewing on most e-Readers and other mobile devices.)

- Publication 4604 (EN/SP), Use the Web for IRS Tax Products & Information

- Publication 1132, Reproducible Copies of Federal Tax Forms and Instructions

- The TFOP Poster Package which includes:

- Publication 1169, Need Tax Help?

- Publication 1258, Where Should I Send This?

- Publication 1309, Tax Forms This Way Publication

- Publication 1725, If The Form Fits...Use It!

No additional products will be available through the TFOP Program. We will not be sending Form 8635-S, Supplement to Form 8635.

We will fill orders for Forms 1040 and 1040A with the quantities you requested on your order form earlier this year. Because Form 1040EZ was not on this year's order form, we will send you 75% of your Form 1040 A order quantity. For example, if you ordered 3000 Form 1040 A, we will send you 2250 Form 1040EZ. It is not necessary for you to place an order for Form 1040EZ; we will automatically ship Form 1040EZ to you once the form becomes available.

Unfortunately, we are unable to offer Instructions for Forms 1040, 1040A and 1040EZ. Your patrons can obtain copies of Instructions through:

- IRS.gov/Forms - to view and download

- IRS.gov/orderforms - to order tax products to be delivered by mail

- 1-800-829-3676 - to order tax products to be delivered by mail

The decision to reduce the number of tax products available to our TFOP partners was not made lightly. We realize this decision is not ideal and we understand it may impact you and your customers. Please offer Publication 4604 (EN/SP) to your patrons to help guide them to tax products and information available on IRS.gov. We apologize for these late program changes.

Thank you for your support,

IRS TFOP Administrator

Which really is terrible news for libraries and patrons - patrons because so many people have relied on easily picking up tax forms at their local library, and libraries because we'll be spending a lot of time apologizing for the IRS to those many irate patrons.

But we can get through this. Libraries near me have been sharing ideas on how to handle these changes. Here's what we'll be doing:

- Printing a sign to explain the situation to people - basically, to say that these are all the tax forms we have and that's all we're getting

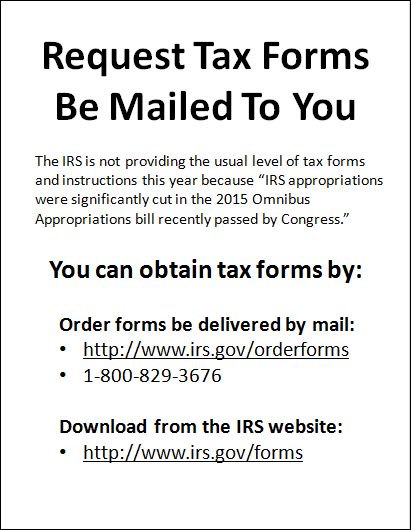

- Have a handout ready with the URL and phone number above for where people can request forms be mailed to them. My first draft [pdf] looks like this:

- Used the order form website myself to get two copies of the instruction booklets so the library will have reference copies

- Printed copies of the 1040, 1040A, and 1040EZ instruction to make circulating copies in three-ring binders for patrons. We're starting with two of each, and will print more as demand increases (because it's a lot of printing). They'll circulate for one week, and we'll allow patrons to place local holds too

- Continue with our "first copy free" policy of printing tax forms for patrons. In the past this has just been for the oddball form here and there, but this year we expect to be printing a lot more*. Although for us, this free copy only applies to forms, not instructions - hopefully the circulating copies or reference copies for photocopying will meet that need

- Make available the IRS' reproducible tax form binder, so patrons can photocopy whatever forms they need

- We may end up pre-printing a lot of the more common schedules and other forms, just to save the patron's (and staff's) time of having to print-on-demand. But again, this is something we're going to wait and see what demand is like and respond accordingly

So, that's our current plan. I'd really like to hear what other libraries are doing, so if you've got a great idea that will help this tax season, please share in the comments.

Good luck.

*I had briefly thought about trying to record all our printing, so get a ballpark figure of how much the IRS' budget cut is costing my library. I hate the idea of shifting costs like that (like when the movie theater hands you an empty cup instead of paying someone to fill it for you! They've just shifted that cost onto their customer. Savages.), but decided that it's probably not worth the cost of our staff tracking, because we'd never use that information for anything anyway. But I'd still be curious to know.